What is special about the way Credit Passport creates credit scores?

Most credit scores are created by looking at the amount of debt you or your company has with the financial system. For companies, it is also common to look at your most recent filed company accounts. However, these accounts usually reflect finances from 12 or 18 months earlier, and the debt only tells one side of the story.

Credit Passport is different. It is the only credit score for business created in real-time, that reflects the fast changing nature of SMEs.

Credit Passport connects to your bank accounts using Open Banking and updates every day. It has been designed from the ground up to reflect how your own bank views and makes lending decisions about you, giving you rare insight into what you need to do to be seen in the best light, how to be more financially resilient, and how to access the lowest lending rates.

What is PSD2?

PSD2 is the acronym for the second ‘Payment Services Directive’, which took effect across the entire European Economic Area on the 13th January 2018.

There are two parts to PSD2. The part we are concerned with here at Credit Passport, is the part that is designed to give consumers more control of the data that their banks hold about them. The thinking behind it is that if you as a consumer of financial services make a request to your bank for the data they hold on you, they have to give it to you. This makes it easier to switch from one banking provider to another, and also to compare financial offers or to aggregate all of your banking relationships into one place.

The way it has been implemented across Europe is for the regulatory bodies, such as the Financial Conduct Authority (the FCA) in the UK to only allow trusted third parties to request this data on the behalf of individuals (or businesses). These regulated third parties are called Account Information Service Providers, or AISP’s for short.

We were one of the first 6 AISP’s in the UK. The company behind us is called CRIF Realtime Ltd. and you can see our authorisation here.

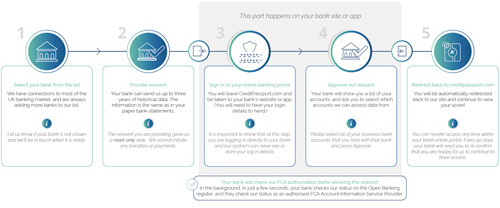

This means that when you ‘connect your bank accounts’ as part of the Credit Passport application process, we will transfer you to your banks website and you tell them (electronically) that you are happy for them to give us access to read your bank account transactions for a specific period of time. This is Read-Only access, and at no point in this process do we ever have direct access to your account or see your log in details. We also only have the ability to READ data, equivalent to receiving your paper bank statements, not to make payments or initiate transfers.

Every 90 days you will need to re-approve the connection request with your bank to keep your Credit Passport current.

The second part of PSD2 is to allow different regulated companies (Payment Service Providers, PSPs for short) to make direct payments from your bank account without a bank card in between. We are not a PSP so cannot do this. Only specific regulated companies can do this, and only with your express permission.

What is Open Banking?

Open Banking is the secure way to give providers like Credit Passport access to your financial information.

OpenBanking.org itself is the organisation in the UK set up by the CMA (Competition and Markets Authority) to oversee the implementation of the European PSD2 directive on behalf of the UK government.

Unlike in other countries, in the UK a decision was made to standardise the way all banks provide the access to their accounts. OpenBanking.org sets out these standards, generates the secure certificates that are used to make a connection, and keeps the directory of all the regulated companies with permission to access accounts. You can view our entry here.

Every time a request for data is initiated, a lookup is made against this directory and it is only processed if there is an active and valid entry.

There are lots of detailed FAQs on the OpenBanklng website here.

Sometimes you may also hear about Open Banking in the press as a concept. This is because it has become the term that refers to the principle of sharing data for a more fair and open financial world.

If you see 'Connect your account with Open Banking' it means that it is secure, regulated, and that you are in control of your data.

What data do I need to provide to get a Credit Passport?

Just as any accountant or financial adviser would, we need to be granted a read-only view of your main business bank account.

You grant us this using our 'Connect your account with Open Banking' screen.

We also look up some additional data from Companies House and other public information sources that list your filled company accounts.

Is my data safe?

We take your privacy very seriously. We do not share any of your data for marketing purposes at all. We are regulated by the Financial Conduct Authority in the UK and the Central Bank of Ireland in the EU, who are responsible, amongst other things, for ensuring we have world class and robust technical and procedural infrastructure in place to provide financial services.

The way Open Banking works, is at no point do we ever see or have access to your banking passwords. After you have told us who you bank with, we redirect you to your banks own website where you log in as you would as usual on their website or app. You approve the request for your bank to send us your account data.

All of our sites and systems are fully encrypted using 256bit encryption, and triple checked by specialist security teams.

Once we have processed your transaction data, even our team cannot access it directly, and only an anonymised version of your account data is made available to our algorithm for continual improvement and data quality monitoring.

Finally, Credit Passport is made by CRIF SpA, one of the largest credit information companies in the world, serving tens of thousands of banks and millions of individuals and businesses globally every day.

Does my bank allow this?

We currently work with most of the UKs biggest banks. If you bank with a different bank, please contact us to see if we can add it for you.

Under the PSD2 directive, all banks in the UK will have to allow Open Banking connections - so if your bank is not connected yet, it soon will be.

How do you connect your banks with Open Banking?

What is a Credit Passport badge?

If you have a Credit Passport score of B or above, you are eligible to get a Credit Passport badge. This simple embed code shows your live Credit Passport score to all of your web visitors, setting your company apart from the competition and demonstrating that you are a reliable and stable business partner for your clients and suppliers.

A Credit Passport badge is available on an active plus plan and above.

It can be inserted into any website by cutting and pasting one line of code, in the same way you would add a YouTube video to a blog. It should only take your web designer a few minutes to do, and you can contact us for any assistance that you need getting it set up.

I connected my bank, why am I being asked to connect my first account?

Credit Passport requires you have transactions in your connected account for at least the last 90 days. Your score will appear as soon as a 90 day history has built up.

If you have an account with a longer history, please connect that one. If not you will need to wait until 90 days to the first transaction has passed before you can view your Credit Passport score.

I cannot find my company using the search box in the sign up form.

All limited companies in the UK should be listed, but if you run as a sole trader or other company type, then unfortunately you cannot register with Credit Passport at this time.

If your company is listed with Companies House, we should be able to find you.

If you are still having trouble, try searching with your company number instead of company name, and let us know if that does not work.

Is it really free?

Yes! - Discovering your Credit Passport business credit score is free, forever. We don't even take payment details when you sign up.

We do offer an optional PLUS plan, with great additional features, such as access to our IMPROVE and SHARE sections, which is £20 + VAT per month - but if you join our free plan you're welcome to use the service to understand and monitor your score without any charges.